Generated Title: Tech's "Big Short" Redux: Are We Really Surprised?

The Inevitable Correction

So, here we are again. Talk of a market implosion, specifically in tech. Everyone’s been calling it, from the IMF to your average Twitter doomscroller. The NASDAQ had a hiccup, and suddenly the "big short" guys are crawling out of the woodwork, dusting off their old playbooks. Are we really surprised? Not even a little.

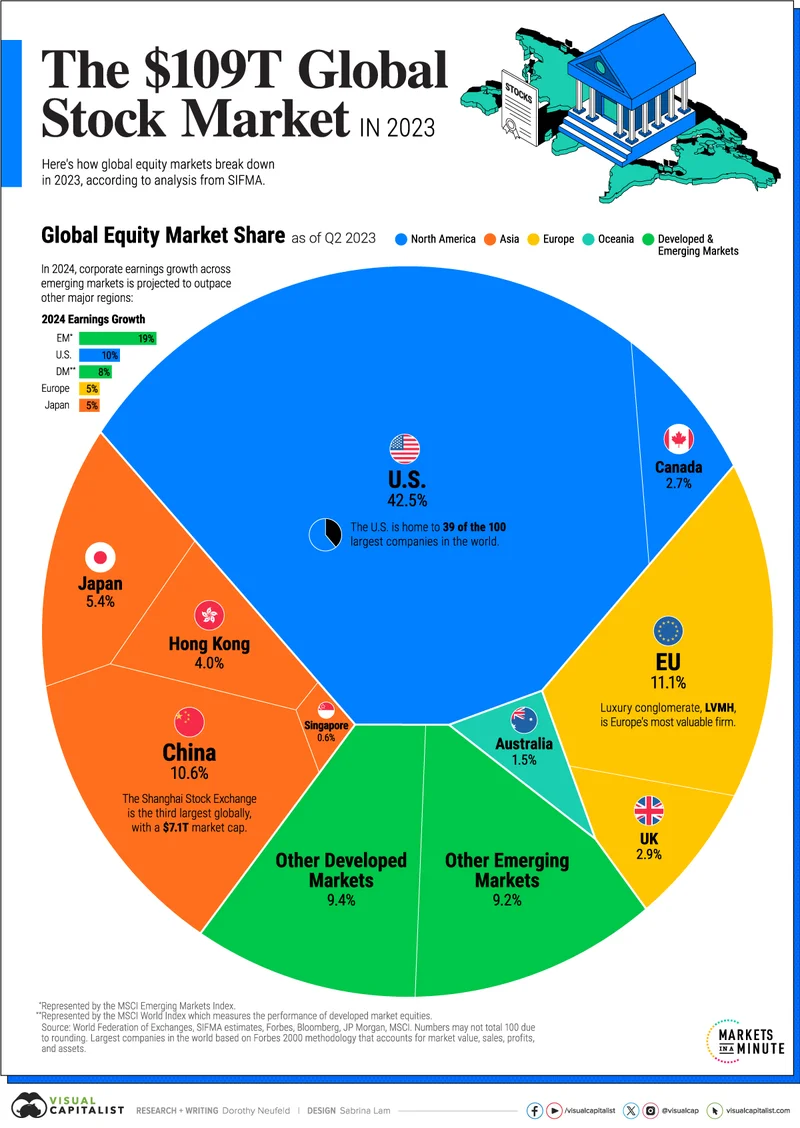

The FTSE 100 took a 1.1% hit on opening, banks like Barclays and Lloyds getting smacked down 3-3.5%. Europe followed suit. Asia got hammered overnight, with Japan's Nikkei dropping 1.8% and South Korea’s Kospi plummeting 2.6%. The culprit? A tech sell-off. Nvidia, that $4.5 trillion behemoth, took a 3.6% tumble. Investors are finally waking up to the fact that maybe, just maybe, AI valuations are a bit… optimistic. (That’s putting it mildly.)

SoftBank bailed on its Nvidia stake, and suddenly everyone’s re-evaluating. SK Hynix and Samsung took dives of over 4% each. Taiwan Semiconductor Manufacturing Company dipped 1.8%. It’s a domino effect, and it was entirely predictable. Global markets fall after tech sell-off and fears over Chinese economy

And then there's China. Fixed-asset investment shrank 1.7% in the first ten months of the year—a record decline, according to their National Bureau of Statistics. Their CSI 300 fell 0.7%, Hong Kong’s Hang Seng dropped 0.9%, and Taiwan’s Taiex slumped 1.4%. The market is like a highly strung rubber band; it will only take so much stretching before it painfully snaps back.

US markets are also twitchy, thanks to the ongoing government shutdown. The government is so dysfunctional that they can’t even release data on inflation and jobs. The uncertainty is a feature, not a bug, of the current system, and uncertainty breeds volatility.

Rate Cut Roulette

The Fed’s next move is anyone's guess. Jim Reid at Deutsche Bank notes the volatility, with "relief over the end of the shutdown vying with concerns over AI valuations." The probability of a December rate cut dropped from 59% to 49% in a single day. Kyle Rodda at Capital.com points out that US valuations have more "air" in them than Asian markets. The AI trade is losing steam, and investors are starting to wonder if they'll ever see a return on their investment.

The pound fell nearly 0.5% against the dollar, landing at $1.31. UK 30-year gilts rose 12 basis points as investors digested Rachel Reeves's U-turn on income tax. It's a mess, a complex web of interconnected factors all pointing in the same direction: down.

Look, the warning signs have been flashing for months. Central bankers have been waving red flags. Investors who made a killing shorting subprime mortgages are back in the game. How much did they make? Estimates vary wildly, but let’s just say it was enough to buy a small island (or three).

It's all a question of when, not if. The market is a coiled spring, and the pressure is building. The tech sector, bloated and overhyped, is the most likely trigger. But the underlying problems—sluggish growth, rising debt, and geopolitical instability—are far more pervasive.

I've looked at hundreds of these market reports, and the level of disconnect between valuation and reality is honestly staggering. The "smart money" knows it, and they're positioning themselves accordingly. Are retail investors paying attention? That’s the million-dollar question. Or rather, the multi-trillion-dollar question.

The Emperor Has No Clothes (Again)

The tech sell-off isn't a black swan event; it's a predictable correction. The market is finally pricing in the unsustainable valuations of AI companies and the broader economic headwinds. The "big short" guys are ready, and frankly, so am I.