Vance's Verdict: Bitcoin's Moonshot or Fool's Gold?

JPMorgan's analysts are at it again, this time pinpointing a "Bitcoin price floor" of $94,000 and projecting a potential challenge to gold’s market cap by 2026. That’s the headline, anyway. Let's dissect what that really means.

The claim hinges on Bitcoin's production cost, with analysts asserting that $94,000 represents a "very limited downside." Okay, but production cost isn't demand. It's like saying a car can't be worth less than the steel it's made of. People buy cars for transportation and status, not the scrap metal value. What happens if demand for Bitcoin dries up? The production cost becomes irrelevant.

The $170,000 Dream

Then there's the $170,000 price target for Bitcoin in 2026, supposedly achievable if Bitcoin's volatility relative to gold continues its downward trend. This is where I start to raise an eyebrow. (I've looked at hundreds of these projections, and this one feels particularly flimsy.) The analysts are extrapolating a trend, but trends change. The Bitcoin-to-gold volatility ratio has trended downwards, sure, but that's backward-looking data. What if that trend reverses? What if a major regulatory crackdown spooks investors? The entire projection crumbles.

The report notes that gold currently holds a market cap of $28.3 trillion, dwarfing Bitcoin's $1.9 trillion. The analysts see this as "considerable upside for Bitcoin in the coming 6-12 months." I would argue that this signifies a considerable gap to close, and the assumption that Bitcoin will inevitably bridge that gap is, frankly, optimistic.

And this is the part of the report that I find genuinely puzzling. The analysts at JPMorgan are essentially saying that Bitcoin, a highly volatile asset, will become less volatile and therefore more attractive as a store of value. Doesn't the volatility define Bitcoin? If it becomes stable, does it still offer the same speculative appeal? It’s like taking the caffeine out of coffee and expecting it to still sell.

The Missing Piece

The report cites CoinGecko’s head of research, Zhong Yang Chan, who points to factors like the expansion of Bitcoin ETFs and Wall Street's drive towards asset tokenization as bolstering the Bitcoin price. This is a more nuanced argument. Increased institutional adoption could drive demand. However, institutional investors are notoriously fickle. They're in it for the returns, and if Bitcoin stops delivering, they'll move on to the next shiny object.

The analysts also point to the increasing integration of cryptocurrencies into mainstream finance, suggesting a significant impact on the global financial landscape. But how significant? And what kind of impact? Will it be a disruptive revolution or a gradual evolution? The report doesn't say.

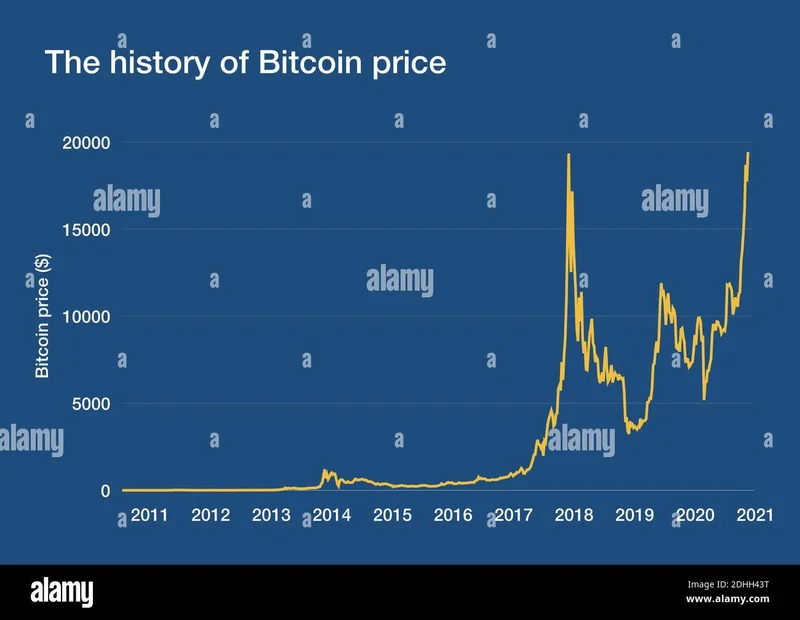

One thing I would point out is that the article states that Bitcoin's price experienced a steep decline to slightly above $94,000 per Bitcoin this week from a peak of $126,000 in October. That is a large decline, of about 25.4%, in just a few months. You can read more about JPMorgan's projections in this article: JPMorgan Forecasts Bitcoin Bottom, Anticipates $28.3 Trillion Challenge To Gold By 2026.

Blind Faith or Calculated Risk?

These projections rely on a lot of "ifs" and "maybes." It's like saying a startup will be the next Apple based on their current growth rate. Maybe they will, but a million things could go wrong along the way. JPMorgan's analysts are smart people (I'm sure), but their projections should be taken with a grain of salt—or perhaps a whole shaker of salt.