MP Materials: From California Mine to Tech Giant? Buckle Up!

Okay, friends, let's talk about something really exciting. We're constantly searching for the next Nvidia, aren't we? That company that seems to be everywhere, driving innovation and delivering those absolutely essential components. Well, what if I told you that the next Nvidia might not be designing chips, but pulling rare earth minerals out of the ground? I know, it sounds crazy, but stay with me.

MP Materials, with its Mountain Pass mine in California, has seen its stock soar 250% this year. Two hundred and fifty percent! That's the kind of jump that makes you sit up and pay attention. And while comparing a mining company to a tech behemoth like Nvidia might seem like comparing apples and spaceships, the core similarity is scarcity. Nvidia's chips are scarce because they're so damn good, so advanced, that few can compete. MP's rare earth elements are scarce because, well, they're rare, and the mine is one of the only scaled sources in the US. China's dominance in the rare earth market further limits production outside its borders, making MP's role even more critical.

The Magnet Revolution

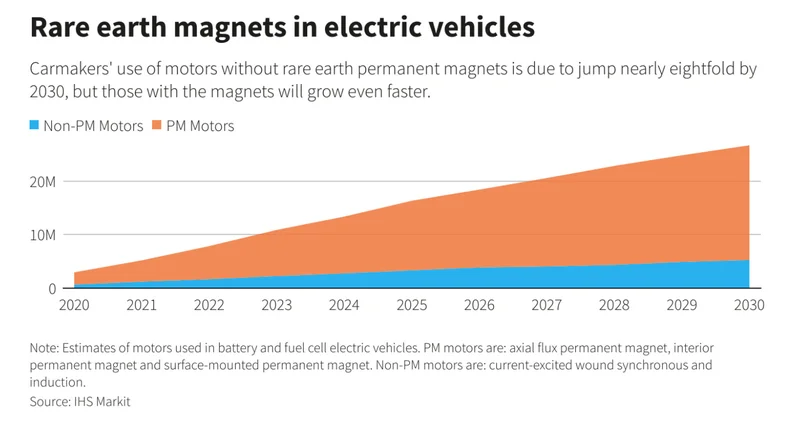

Think about it: rare earth magnets are everywhere. They're in your phone, your laptop, your car door, your kitchen blender, and, crucially, in every electric vehicle rolling off the assembly line. These magnets are essential for modern technology, and MP Materials is poised to become a major player in supplying them. It's like the California Gold Rush, but instead of gold, it's neodymium and praseodymium (NdPr)—the elements that give these magnets their incredible strength. This isn't just about digging stuff out of the ground; it's about fueling the future. The Trump administration clearly saw this, investing $400 million in MP Materials to reduce US reliance on Chinese imports. That's a powerful statement about the strategic importance of this company.

Now, let's be real. MP Materials isn't quite Nvidia yet. Nvidia is a high-margin tech company riding the AI wave, while MP is a mining company with all the capital expenditures and commodity cycle vulnerabilities that come with it. The free cash flow difference is…stark. But here's the thing: MP is still building its second magnet factory, the "10X Facility," which promises to supercharge revenue growth and free cash flow. We could be looking at a situation where Nvidia's growth plateaus just as MP's sales are taking off. It's all about timing, isn't it?

Of course, there are risks. MP needs to successfully scale its magnet production, and its valuation is rich, especially considering it's currently unprofitable. To reach Nvidia's trillion-dollar valuation, MP would need to climb a staggering 44,900% from its current price. A tall order, indeed! But I think we're missing the bigger picture. This isn't just about one company's stock price; it's about securing a domestic supply chain for critical materials.

Here's where things get really interesting. Recent headlines about a US-China trade truce might lull some into a false sense of security, but Beijing is crafting a "validated end-user" (VEU) system. This system is a surgical tool designed to maintain the flow of rare earths to approved, purely civilian American companies while explicitly blocking access for the U.S. military and its contractors. This isn't de-escalation, folks. This is a targeted strike in the global tech and defense race. And it makes MP Materials, along with companies like USA Rare Earth, absolutely mission-critical for the US.

China's VEU plan directly elevates the importance of MP, especially its contracts with the Department of Defense. The 10-year price floor, which began on Oct. 1, is a direct countermeasure, guaranteeing revenue stability for the very products China seeks to restrict. MP Materials’ recent third-quarter 2025 earnings report showed record production of 721 metric tons of high-value NdPr, demonstrating its ability to meet this secure demand with sufficient feedstock. With a $1.94 billion cash hoard, it has the firepower to accelerate its build-out to meet any new defense-related demand surges.

And what about the market's reaction? Well, it seems the market overreacted to the "truce" headlines, creating a valuation disconnect. Analyst consensus remains a Moderate Buy on both MP Materials and USA Rare Earth, and the recent price drops have made the upside to their average price targets even more compelling. Adding fuel to the fire is the high level of short interest against the sector, standing at a compelling 17.89% for MP and 14.45% for USAR. Any sudden geopolitical escalation, such as a formal announcement of China's VEU list or a new U.S. defense contract, could instantly invalidate the bearish thesis, forcing short-sellers to buy back shares en masse. Talk about a coiled spring! Rare Earth Stocks: The Truce That Isn't a Truce

The race for rare earth supremacy is accelerating, and for investors with a long-term horizon, the market's current fear may have just put a strategically vital sector on sale.

What does this all mean? I think we're on the cusp of a new era, where the materials that underpin our technology become as strategically important as the technology itself. MP Materials isn't just a mining company; it's a key piece of the puzzle in securing America's technological future.

A Future Forged in the Earth

It's not just about profit margins or stock prices; it's about national security, technological independence, and building a future where the US controls its own destiny. And honestly, that's a future worth investing in.