MicroStrategy's Bitcoin Bet: Panic or Prudence?

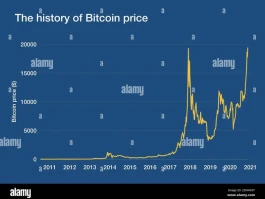

Bitcoin's recent dip below $96,000—a six-month low—has sent shivers down the spines of crypto investors. The timing couldn't be worse for MicroStrategy (MSTR), a company that's essentially hitched its wagon to the Bitcoin star. The market's reaction has been swift and brutal, but is it justified, or is this just another case of knee-jerk selling fueled by crypto Twitter's penchant for drama?

The initial panic stemmed from a massive Bitcoin transfer—58,915 BTC, worth about $5.77 billion—out of MicroStrategy's wallets. Cue the speculation: was the company about to dump its holdings? Analysts quickly debunked this theory, suggesting it was a custodial restructuring. (Think of it like moving your cash from a checking account to a vault; the money is still yours, just in a different location.) But the damage was done. Bots and algo traders had already reacted, exacerbating the price drop.

The truly worrying signal, however, wasn't the wallet shuffle; it was the drop in MicroStrategy's Net Asset Value (NAV) multiple. For the first time, it dipped below 1. This means the market was valuing MSTR shares at less than the value of its Bitcoin holdings minus liabilities. A NAV below one suggests investors are deeply concerned about MicroStrategy's debt risk, liquidity, or the sustainability of its Bitcoin-heavy strategy. Now, the mNAV value is back above, at 1.09, which is still low.

K33 Research highlighted a $79.2 billion drop in MicroStrategy's equity premium since November 2024. They noted that while MicroStrategy raised $31.1 billion through dilution, nearly $48.1 billion of implied Bitcoin demand never translated into actual BTC purchases. In simpler terms, the market’s appetite for MSTR as a proxy for Bitcoin exposure is waning, and fast.

Deeper Dive: The Debt Question

The key to understanding the market's unease lies in MicroStrategy's debt. The company has aggressively borrowed money to buy Bitcoin, betting that the cryptocurrency's price appreciation would outpace its interest payments. But what happens if Bitcoin's price stagnates or, worse, continues to decline? That's when the debt burden becomes a real problem.

One analyst, Willy Woo, downplayed the risk of forced liquidation, stating that MicroStrategy is unlikely to be forced to sell Bitcoin as long as MSTR trades above $183.19 by 2027, a level tied to roughly $91,500 BTC, assuming a 1x NAV multiple. But this assumes Bitcoin will recover and MSTR will hold its value. What if Bitcoin languishes below that level for an extended period?

And this is the part of the analysis that I find genuinely puzzling. MicroStrategy's aggressive Bitcoin-buying strategy was predicated on a near-constant bull market. It's like betting your entire savings on a horse race and then being surprised when the horse doesn't win every single time.

The $70,000 Question

Adding fuel to the fire, technical analyst TraderJonesy is predicting a 30% Bitcoin crash—a move that "nobody sees coming"—targeting the $70,000 level. He points to a pattern of lower highs and lower lows, suggesting significant downside remains. While the broader market analysis paints a different picture, with the article mentioning the cryptocurrency's year-low sits at $74,421, a level that now represents major downside risk if current support zones fail. Why Bitcoin Is Falling? BTC Plunges Below $96K And May Crash 30% According to This New Bitcoin Price Prediction

It's worth noting that Bitcoin's 50-week exponential moving average currently intersects at $101,285. Trading at $95,722 (actually, to be more exact, it was that price on the 14th, and is likely different now), Bitcoin would need to surge over 6.8% just to regain this technical threshold.

The question now is not whether MicroStrategy can survive a Bitcoin downturn, but how much pain it's willing to endure. The company's fate is now inextricably linked to the volatile cryptocurrency market. The market's reaction—the NAV dropping below 1—is a clear signal that investors are starting to question the wisdom of that strategy. What happens if we see another black swan event? What's MicroStrategy's plan B?

A High-Stakes Game of Chicken

```

Time To Reassess The Risk Model

```

MicroStrategy's bet on Bitcoin has been a wild ride, but the recent market turmoil is a stark reminder that even the boldest strategies can unravel. The company needs to demonstrate a more nuanced approach to risk management, or it risks becoming a cautionary tale in the annals of corporate finance.

```